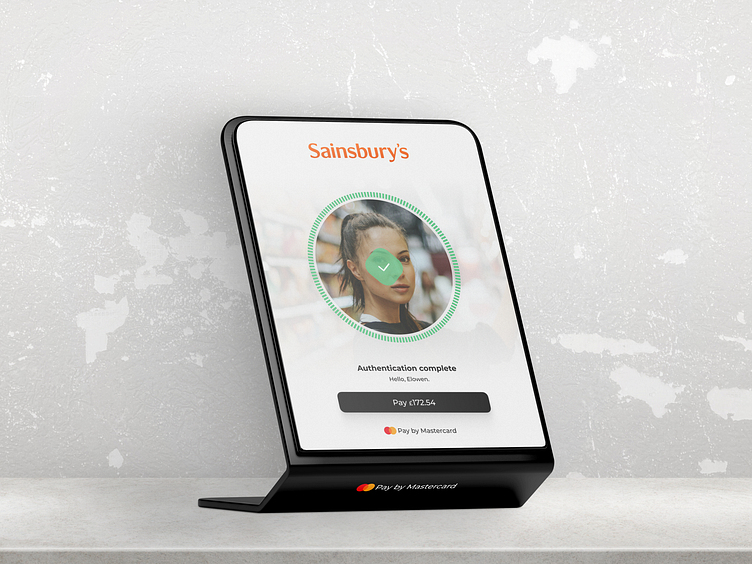

Redefining Payment Experiences: The FacePay Concept

As a seasoned senior product designer with over 11 years of experience, I've always been drawn to innovative payment solutions that bridge convenience and security. When I came across an article on China's cutting-edge face recognition payment system, I couldn't help but imagine the possibilities. The concept of a world without credit cards, phones, or apps, where your face is your key to payment, intrigued me immensely. This became the inspiration for my latest project - FacePay for Mastercard, designed with a real-world use case at Sainsbury's.

The Vision:

Sainsbury's, the retail giant with a 15.4% market share and a turnover of €33.79 billion in 2021, provided the ideal setting for my concept. With a commitment to value and customer satisfaction, Sainsbury's was the perfect partner to explore a novel payment experience.

The idea was simple yet revolutionary. Instead of reaching for your wallet or phone, shoppers at Sainsbury's could now complete their transactions with just a glance. The cashier would send the bill's total to the Mastercard Stand tablet at the reception, and our advanced AI recognition system would handle the rest. No cards, no apps, just your face – fast, secure, and convenient.

The Impact:

The introduction of FacePay not only streamlines the payment process but also has positive environmental implications. Customers have the choice to skip paper bills, contributing to Sainsbury's efforts to reduce their environmental footprint.

Facts and Figures:

In 2021, Sainsbury's reported a remarkable turnover of €33.79 billion, firmly securing its position in the retail industry.

Sainsbury's CEO, Simon Roberts, remains committed to offering the best value to shoppers, investing over £560 million to keep prices low over the last two years.

Debit cards are prevalent in the UK, with the average person holding 2-3 cards. 90% of the population is either Visa or Mastercard cardholders, with cards accounting for approximately 90% of all online payments.

The UK's embrace of various payment methods, from traditional credit cards to 'buy now, pay later' options and digital wallets like Apple Pay and Google Pay, demonstrates a diverse and tech-savvy market.

The global usage of face detection and AI in payments is on the rise, providing both convenience and enhanced security. In an era where data privacy and contactless payments are paramount, FacePay emerges as the future of seamless transactions.