Advance VAT Return - Step 2

At the end of last year, we shipped the first iteration of the FastBill advance VAT return process. The overall process in split-up in small and easy to process junks, so the user doesn't get overwhelmed with too bureaucratic and complex input fields.

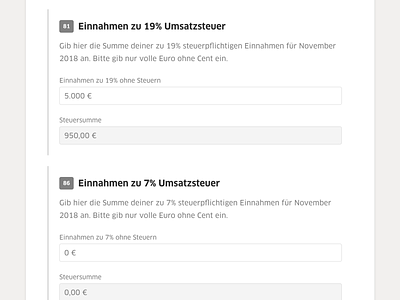

This is the second step of the form wizards. It is the primary screen of the overall form wizard. A user can enter different values for the calculation of the VAT return and die transmission to the tax authority. The input fields have a strict form validation and conform to the strict rules of the German tax authority.

Posted on

Feb 1, 2019

More by Jan Früchtl View profile

Like